IN THIS ISSUE

MBAC Fertilizer: There's Value in Growing Food

By Cara Jacobsen, D3 Family Funds

Blind Faith

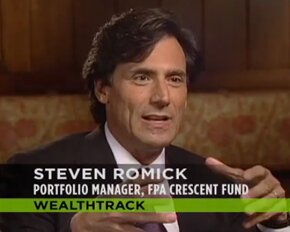

By Steven Romick, First Pacific Advisors

A Small Cap Biotech That is a Cash Flow Genera

By Tim Eriksen, Eriksen Capital Management

What the Market Expects from Apple

By Galileo Russell

Residential Housing Presents a Compelling Inve

By Jeff Pintar, Pintar Investment Company

Bears Light Up Universal Display

By Jeff Uscher

FINANCIAL AND BUSINESS NEWSFINANCIAL AND BUSINESS VIDEOSVALUE INVESTING ARTICLESVALUE INVESTING VIDEOS |

THIS MONTH'S ISSUE

A Small Cap Biotech That is a Cash Flow Generating Machine

By Tim Eriksen, Eriksen Capital Management

The goal of every enterprising investor is to achieve attractive absolute returns and to outperform a passive index approach over time. The best way to achieve that is to focus on the least efficient segments of the stock universe. As Seth Klarman wrote in Margin of Safety, “ample investment opportunities may exist in the securities that are excluded from consideration by most institutional investors. Picking through the crumbs left by the investment elephants can be rewarding.” In other words, we should fish where others are not.

LEAVE A COMMENT

You must be logged in to post a comment.

|